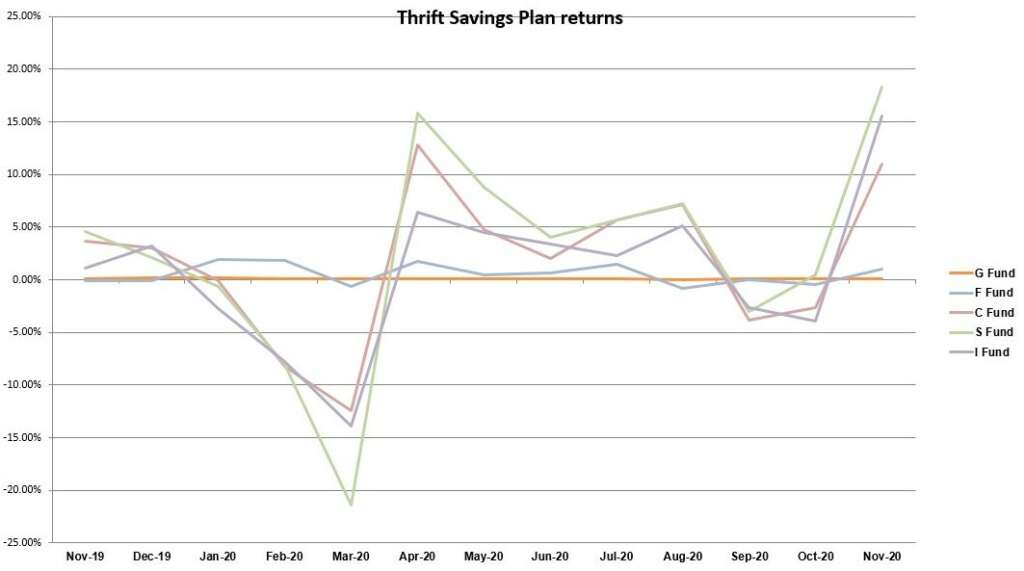

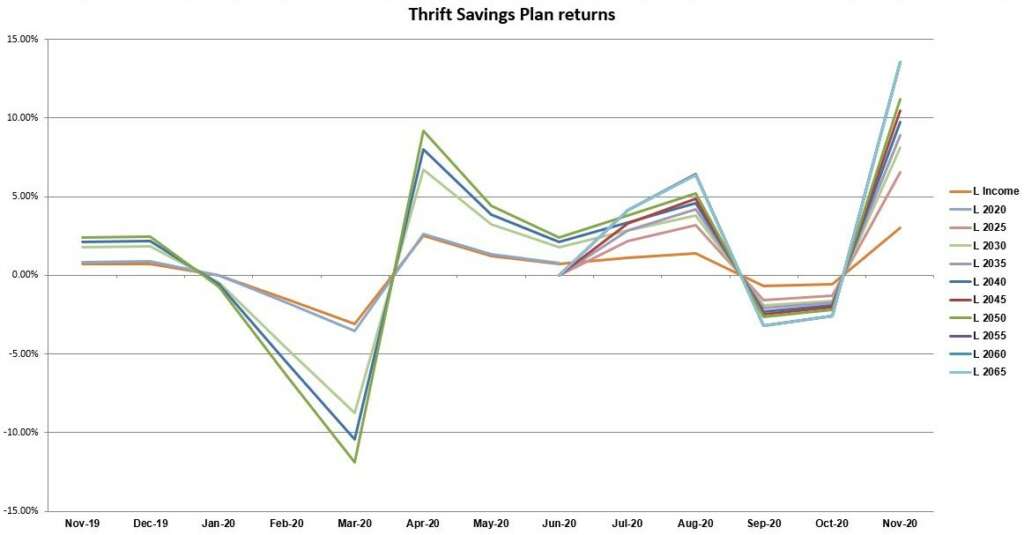

Last month the Thrift Savings Plan received an adrenaline boost as fund performance rose dramatically across the board. Returns released Tuesday showed monthly improvements reminiscent of this spring, with every fund ending in the black and several making double-digit growth.

The biggest month-over-month improvement was the international stock index I Fund, which rose from -3.97% in October to 15.54% in November — a difference of 19.51%. The second-largest improvement was in the small capitalization stock index S Fund, which went from 0.50% in October to 18.26% in November — a difference of 17.76%.

The common stock index investment C fund’s monthly performance increased from -2.66% in October to 10.95% last month, while the fixed income investment F fund only changed from -0.42% to 0.99% in November.

The smallest improvement was in the securities-backed G fund, which slightly rose from 0.06% in October to 0.07% last month. But year over year, performance was down 0.07 percentage points. Despite a reputation for stability, the G fund has steadily declined for the last 30 years as interest rates on those securities have declined, Federal News Network previously reported.

Among Lifecycle funds, the L 2055, 2060 and 2065 each saw returns rise from -2.60% in October to 13.55% in November. The L 2050 improved from -2.17% to 11.19%, while the L 2045 rose from -2.04% to 10.47% during that time. Monthly returns for the L 2025, 2030, 2035 and 2040 funds ranged from 6.56% to 9.74% — which is notable after finishing October entirely in the red.

The L Income fund went from -0.58% in October to 3.00% in November, a difference of 3.58% month-over-month and a change of 2.29% year-over year.

Broadening the view, TSP performance compared to November 2019 was less stark though still improved. The I fund had risen the most last month versus the same time a year ago.

Meanwhile, TSP participants can expect some new services in 2022, thanks to a recent contract awarded to Accenture Federal Services for the Federal Retirement Thrift Investment Board’s recordkeeping services acquisition (RKSA). The procurement encompasses managing the TSP call centers and software that process participants’ transactions, as well as improving the plan’s cybersecurity posture and IT infrastructure, Federal News Network reported.

| Thrift Savings Plan — November 2020 Returns | |||

| Fund | Nov. | Year-to-Date | Last 12 Months |

| G fund | 0.07% | 0.89% | 1.05% |

| F fund | 0.99% | 7.35% | 7.27% |

| C fund | 10.95% | 13.93% | 17.36% |

| S fund | 18.26% | 22.95% | 25.59% |

| I fund | 15.54% | 3.37% | 6.72% |

| L Income | 3.00% | 4.04% | 4.81% |

| L 2025 | 6.56% | n/a | n/a |

| L 2030 | 8.10% | 8.24% | 10.22% |

| L 2035 | 8.92% | n/a | n/a |

| L 2040 | 9.74% | 9.51% | 11.86% |

| L 2045 | 10.47% | n/a | n/a |

| L 2050 | 11.19% | 10.56% | 13.24% |

| L 2055 | 13.55% | n/a | n/a |

| L 2060 | 13.55% | n/a | n/a |

| L 2065 | 13.55% | n/a | n/a |

Comments are closed.